Six listings are currently scheduled for the week ahead, three of which plan to raise over $100 million.

Chinese premium EV brand ZEEKR (ZK) plans to raise $341 million at a $4.8 billion market cap. The company was originally part of Chinese auto giant Geely Auto, but was restructured as a separate company in 2021. Its current product portfolio includes two cross-over hatchback models, a luxury MPV, and a compact SUV. As of December 31, 2023, it has cumulatively delivered nearly 197,000 vehicles. The company has expanded rapidly since being spun-out, and posted 91% revenue growth in the 9mo23. Despite this, it remains unprofitable, and operates in an increasingly competitive space.

Auto transport rollup Proficient Auto Logistics (PAL) plans to raise $215 million at a $387 million market cap. Formed in connection with the IPO through the combination of five operating companies, Proficient Auto Logistics will operate what it states is one of the largest auto transportation fleets in North America, utilizing roughly 1,130 auto transport vehicles and trailers on a daily basis. Customers include auto makers, auto dealers, auto auctioneers, rental car companies, and auto leasing companies. The company has presented double digit pro forma revenue growth in the past two years, aided by industry tailwinds, but derived 60% of its 2023 revenue from just five customers.

Design software and services provider Silvaco (SVCO) plans to raise $108 million at a $555 million market cap. Silvaco provides technology computer aided design software, electronic design automation software, and semiconductor intellectual property for semiconductor and photonics companies. Silvaco has a leading position in the technology computer-aided design market, but has been unprofitable in numerous recent quarters with minimal cash flows.

Oncology and autoimmune biotech Lirum Therapeutics (LRTX) plans to raise $25 million at a $103 million market cap. Lirum’s lead candidate, LX-101 is an in-licensed targeted therapy directed to the insulin-like growth factor-1 receptor (IGF-1R), which was previously evaluated by the licensor in Phase 1a trials in advanced, pretreated cancer. Lirum plans to advance LX-101 through Phase 1b/2 trials in select oncology indications and Phase 1 trials in select thyroid eye disease indications.

Pre-revenue nuclear microreactor developer Nano Nuclear Energy (NNE) plans to raise $15 million at a $161 million market cap. The company is focused on micro nuclear reactors, fuel fabrication, fuel transportation, and nuclear consultation services.

Early-stage mining company Key Mining (KMCM) plans to raise $10 million at a $55 million market cap. The pre-revenue company has two exploration-stage projects in Chile, one focused on exploring for rutile, and the other focused on exploring for copper and zinc.

| U.S. IPO Calendar | |||

|---|---|---|---|

| Issuer Business | Deal Size Market Cap | Price Range Shares Filed | Top Bookrunners |

| Nano Nuclear Energy (NNE) New York, NY | $15M $161M | $4 - $6 3,000,000 | Benchmark |

| Developing nuclear microreactors and related fuel technologies. | |||

| Lirum Therapeutics (LRTX) New York, NY | $25M $103M | $10 - $12 2,270,000 | ThinkEquity |

| Phase 1 biotech developing an in-licensed therapy for cancer and autoimmune diseases. | |||

| Proficient Auto Logistics (PAL) Jacksonville, FL | $215M $387M | $14 - $16 14,333,333 | Stifel Raymond James |

| Roll-up of auto transportation and logistics services providers. | |||

| Silvaco (SVCO) Santa Clara, CA | $108M $555M | $17 - $19 6,000,000 | Jefferies TD Securities |

| Provides design automation software and semiconductor IP solutions. | |||

| ZEEKR (ZK) Ningbo, China | $341M $4,760M | $18 - $21 17,500,000 | Goldman Morgan Stanley |

| Premium electric vehicle brand spun out of Chinese automaker Geely. | |||

| Key Mining (KMCM) Miami, FL | $10M $55M | $2.25 4,444,444 | EF Hutton |

| Florida-based mining company with two exploration-stage projects in Chile. | |||

Sign up for a free trial of our premium platform, IPO Pro. To get our IPO calendar in your inbox, register here.

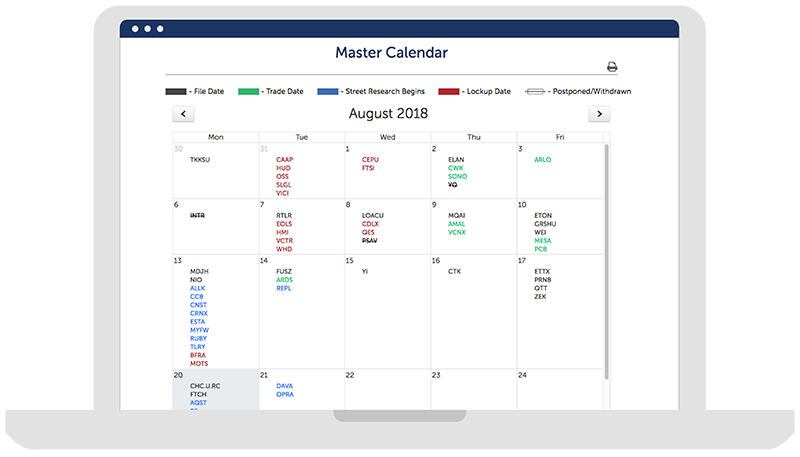

Street research is expected for seven companies in the week ahead, and lock-up periods will be expiring for four companies. For access to Street research and lock-up expiration dates, sign up for a free trial of IPO Pro.

IPO Market Snapshot

The Renaissance IPO Indices are market cap weighted baskets of newly public companies. As of 5/2/2024, the Renaissance IPO Index was up 1.1% year-to-date, while the S&P 500 was up 6.6%. Renaissance Capital's IPO ETF (NYSE: IPO) tracks the index, and top ETF holdings include Kenvue (KVUE) and Nu Holdings (NU). The Renaissance International IPO Index was up 3.7% year-to-date, while the ACWX was up 3.4%. Renaissance Capital’s International IPO ETF (NYSE: IPOS) tracks the index, and top ETF holdings include Barito Renewables Energy and Porsche.